Condo Insurance in and around Okeechobee

Here's why you need condo unitowners insurance

Condo insurance that helps you check all the boxes

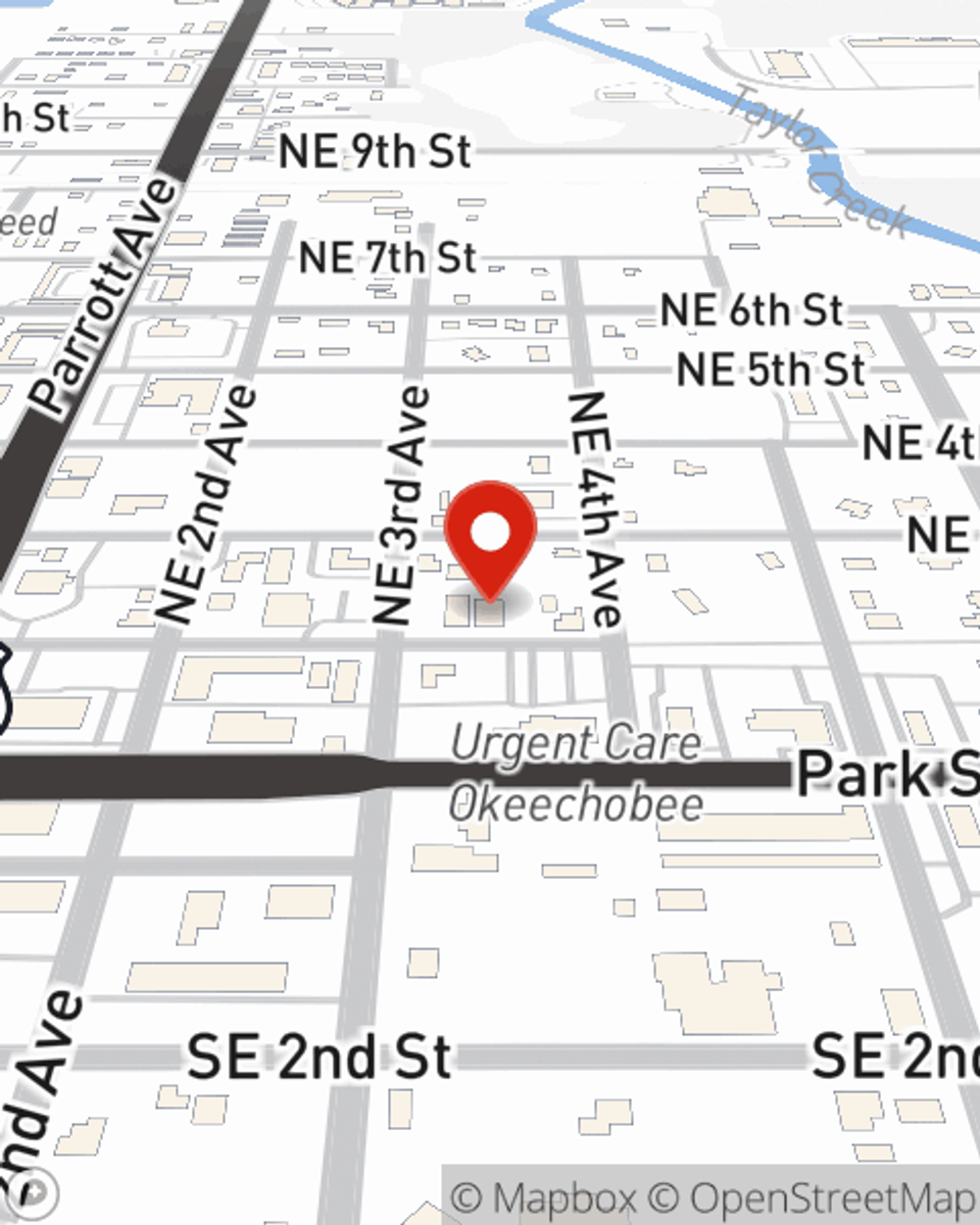

- Okeechobee

- Okeechobee County

- Glades County

- Highlands County

- Martin County

- Moore Haven

- Saint Lucie County

- Belle Glade

- Polk County

- Sebring

- Lake Placid

- Indian River County

- Osceola County

- Port St Lucie

- Placid Lakes

- Indiantown

- Jupiter

- Palm Beach County

- Wellington

- Westlake

- Fort Pierce

- Fort Pierce North

- Hobe Sound

- Vero Beach

Calling All Condo Unitowners!

Because your condo unit is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to vandalism or weight of sleet. That's why State Farm offers coverage options that may be able to help protect your largest asset.

Here's why you need condo unitowners insurance

Condo insurance that helps you check all the boxes

Condo Coverage Options To Fit Your Needs

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Gretchen Robertson is ready to help you navigate life’s troubles with dependable coverage for all your condo insurance needs. Such thoughtful service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Gretchen Robertson can help you submit your claim. Keep your condo sweet condo with State Farm!

Call or email State Farm Agent Gretchen Robertson today to learn more about how one of the well known names for condo unitowners insurance can help protect your townhome here in Okeechobee, FL.

Have More Questions About Condo Unitowners Insurance?

Call Gretchen at (863) 763-5561 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Gretchen Robertson

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.